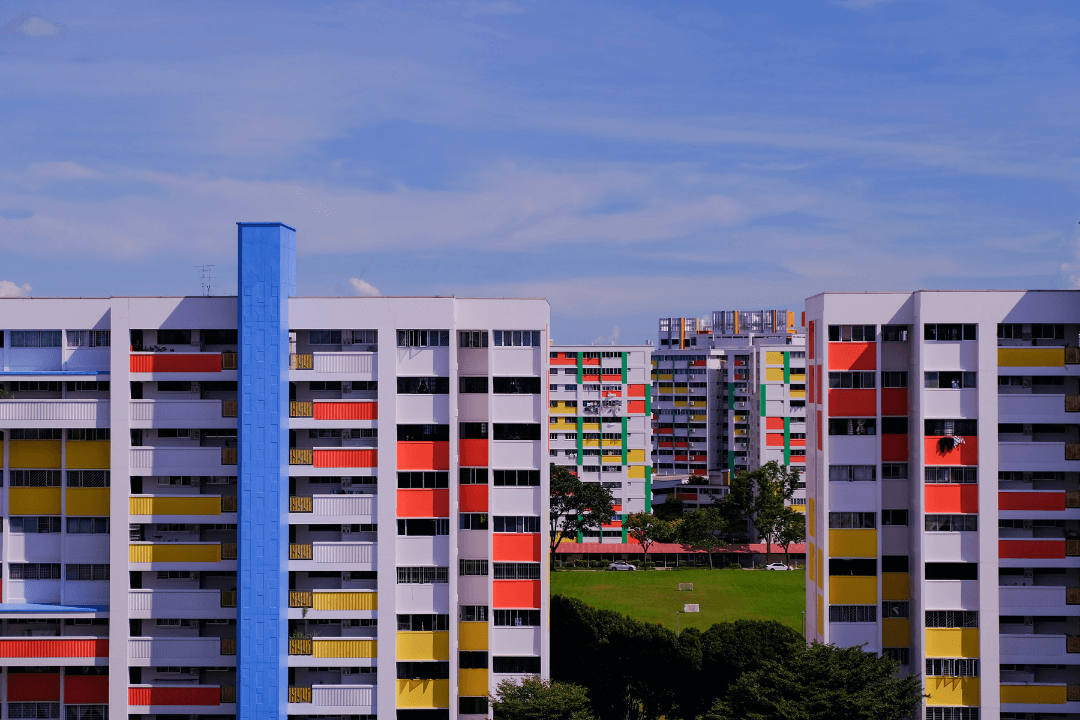

Property cooling measures have been introduced by the government due to the fact that more HDB flats were sold for more than S$1 million during the first nine months of 2022, compared to the entire year of 2021.

These measures are aimed at easing the demand for HDB flats and tightening loan restrictions, which may impact private property owners looking to downsize to HDB flats and obtain a home loan in Singapore.

So, what are these measures and how might they affect you?

In our role as Singapore’s first mortgage fintech platform, let’s walk through this together so that you can make an informed decision on whether you should apply for that property loan.

What are the Property Cooling Measure in effect

TDSR & MSR

While the actual interest rate for a home loan in Singapore is still set by the bank, the interest rate floors are used to calculate the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR).

- TDSR

The TDSR is the percentage of your income that goes towards repaying all your monthly loan obligations, including things like car loans and property loans.

The current limit on the TSDR is 55%, meaning that if your salary is S$5000 a month, your repayments cannot exceed S$2,750.

- MSR

MSR is similar to TDSR, but is only related to a property loan to purchase an HDB flat and Executive Condominium (EC) that’s directly from the developer.

- There is no MSR for private housing. TDSR will be applicable after assessing MSR if you are taking up a bank loan.

Currently, the limit for MSR is 30%, meaning that if you earn S$10,000 a month, your property loan repayments cannot exceed S$3,000.

These figures determine the amount of money you can borrow on a home loan in Singapore, which ensures that you are not overburdened and that the property market overall remains healthy.

For the same reason, a home loan from HDB would also have a new interest rate floor of 3% for calculating the eligible property loan amount. The actual interest rate, however, is still determined by HDB at 2.6% per annum(p.a.) from 1 October 2022 to 31 December 2022.

Loan-To-Value (LTV) limit for an HDB home loan in Singapore is lowered

In addition to the restrictions on taking a home loan in Singapore, the LTV limit for HDB housing loans is reduced from 85% to 80%.

According to MAS, the LTV limit is the maximum amount an individual can borrow from a financial institution (FI) for a housing loan.

LTV is the loan amount as a percentage of the property’s value. If someone takes out S$850,000 to pay for an HDB valued at S$1,000,000, the LTV is 85%.

| Property value | 85% loan (Past) | 80% loan (Current) | Cash/CPF top-up needed | Monthly loan repayment at 85%* | Monthly loan repayment at 80%* |

| $300,000 | $255,000 | $240,000 | $15,000 | $1,209 | $1,138 |

| $500,000 | $425,000 | $400,000 | $25,000 | $2,015 | $1,897 |

| $800,000 | $680,000 | $640,000 | $40,000 | $3,225 | $3,035 |

| $1,000,000 | $850,000 | $800,000 | $50,000 | $4,031 | $3,794 |

Source: The Straits Times (Values are accurate as of 2 December 2022)

From the table above, assuming a property value is S$1,000,000, a 5%

reduction in the home loan amount would result in a S$50,000 increase in the amount needed to purchase the property.

So, if you were thinking of buying an HDB flat in the future, there will probably be a greater upfront cost.

This would further increase the amount of money you have to pay upfront.

Wait-Out Period for buying resale HDB flats introduced to moderate demand

In addition to the measures above, the government has also introduced a 15-month wait-out period for private property owners (PPOs) and ex-PPOs to buy an HDB resale flat.

This would mean that after selling their private property, ex-PPOs will have to find other accommodations for a while before being able to buy their HDB flat.

This does not affect the wait-out period for PPOs who wish to apply for the CPF Housing Grant and the Enhanced CPF Housing Grant to buy their resale flat, which remains at 30 months.

The government is doing this to lower demand and ensure that flats are affordable for first-time HDB flat buyers.

However, there is an exception made for seniors (aged 55 and above) who wish to downgrade to a smaller HDB flat, including the 2-room Flexi flat on the short lease, and the Community Care Apartment (for ages 65 and above).

If you are facing any circumstances that make it necessary and urgent for you to downsize to an HDB flat, HDB will assess your situation on a case-by-case basis.

How do the Property Cooling Measures affect you?

Earlier, we saw how the property cooling measures would make things difficult for buyers taking out a home loan to purchase their HDB flats. What about the rest of us?

Unfortunately, these measures probably impact you in some way, shape, or form.

The effects on the resale market

If you’re a resale HDB seller, the measures may not be a good thing. Instead, they may prevent private property owners – who are able to pay more for an HDB flat and inflate HDB purchase prices – from purchasing the flats.

Those who are looking to maximise their home loan borrowing in Singapore to buy a resale HDB flat may find themselves unable to, based on the new floor rate interest and lower LTV for loan obtained from HDB.

The matching rate between buyers and sellers would slow, resulting in a cooling of the market.

The effects on the rental market

If you’re currently renting an apartment, this is bad news. The wait-out period would force many ex-PPOs to find alternative accommodation, while waiting to purchase their resale HDB flats.

Many of these people would turn to rent and this will reduce the number of rentals available, further inflating prices. This comes on top of the 40 to 41% rise in median rent across HDB flat types since last year, putting HDB rent prices at an all-time high.

Rental of private homes isn’t safe either, with rents for high-end non-landed private residential projects being 7.6% quarter-on-quarter in Q2 2022.

The effects on the private property market

On the other hand, the private property market is unlikely to experience any negative impacts from the cooling measures.

As the market is more influenced by people upgrading from their HDB flats to a private property after fulfilling their minimum occupancy period (MOP), they are therefore less likely to be impacted apart from maybe a slight slowdown.

However, with the greater payment upfront, many prospective buyers may now have to consider between upgrading to a private property, or buying a larger resale HDB.

What to expect moving forward

In all, the negative impact of the policies will be more short-term, with measures like the wait-out period being temporary and open to change in the future depending on market conditions.

Such measures may be beneficial in the future as they will instil confidence in those who would like to invest in the Singapore property market and ensure its sustainable growth in the future.

Reach out to us

Be it planning out your property purchase or taking out a home loan in Singapore, our team of experts will be more than happy to help. Your financial future starts with the right advice – reach out to us, and let’s embark on this journey together. Contact us now to schedule a personalised consultation and gain invaluable insights into your mortgage loan options.