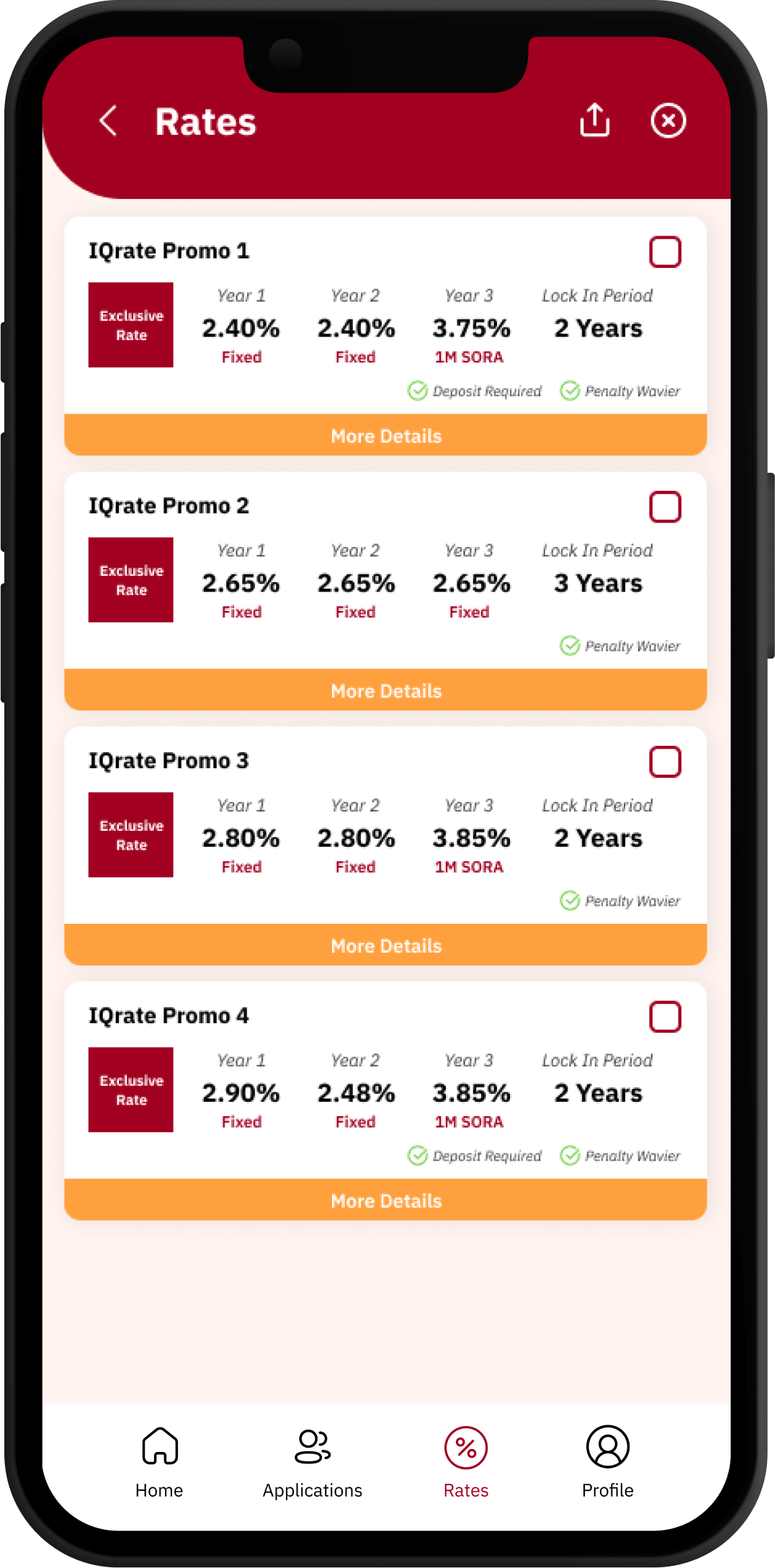

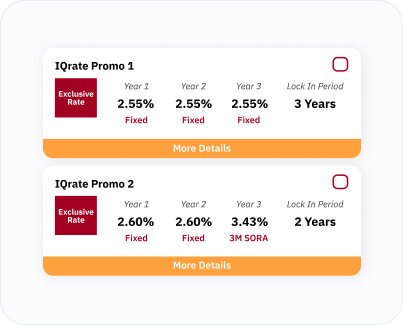

Get instant access to the most competitive and up-to-date mortgage loan rates tailored just for you.

Refinance

0.00%

New Purchase

0.00%

New Purchase(BUC)

0.00%

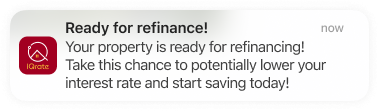

Get timely notifications for your refinance eligibility to ensure you never miss out on potential savings.

Enjoy exclusive mortgage rates with IQrate and earn extra cash rewards for every successful loan application accepted through our platform. Save more and get rewarded!

Stay ahead with the most accurate and up-to-date information! Our real-time mortgage loan rates feature ensures that you always get the latest and best interest rates.

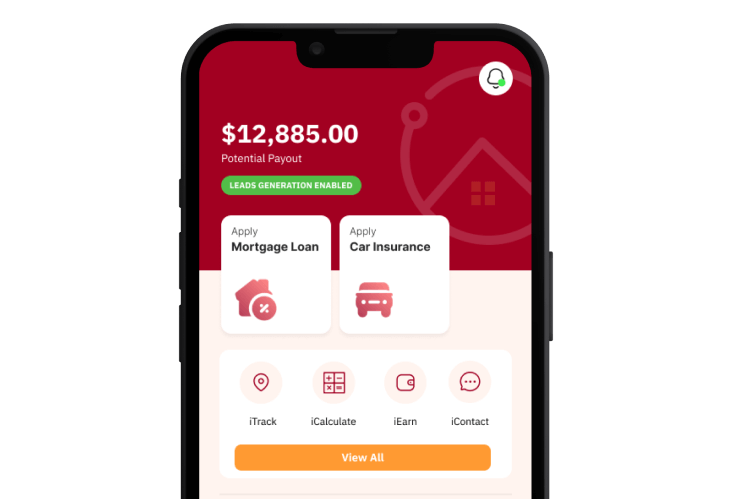

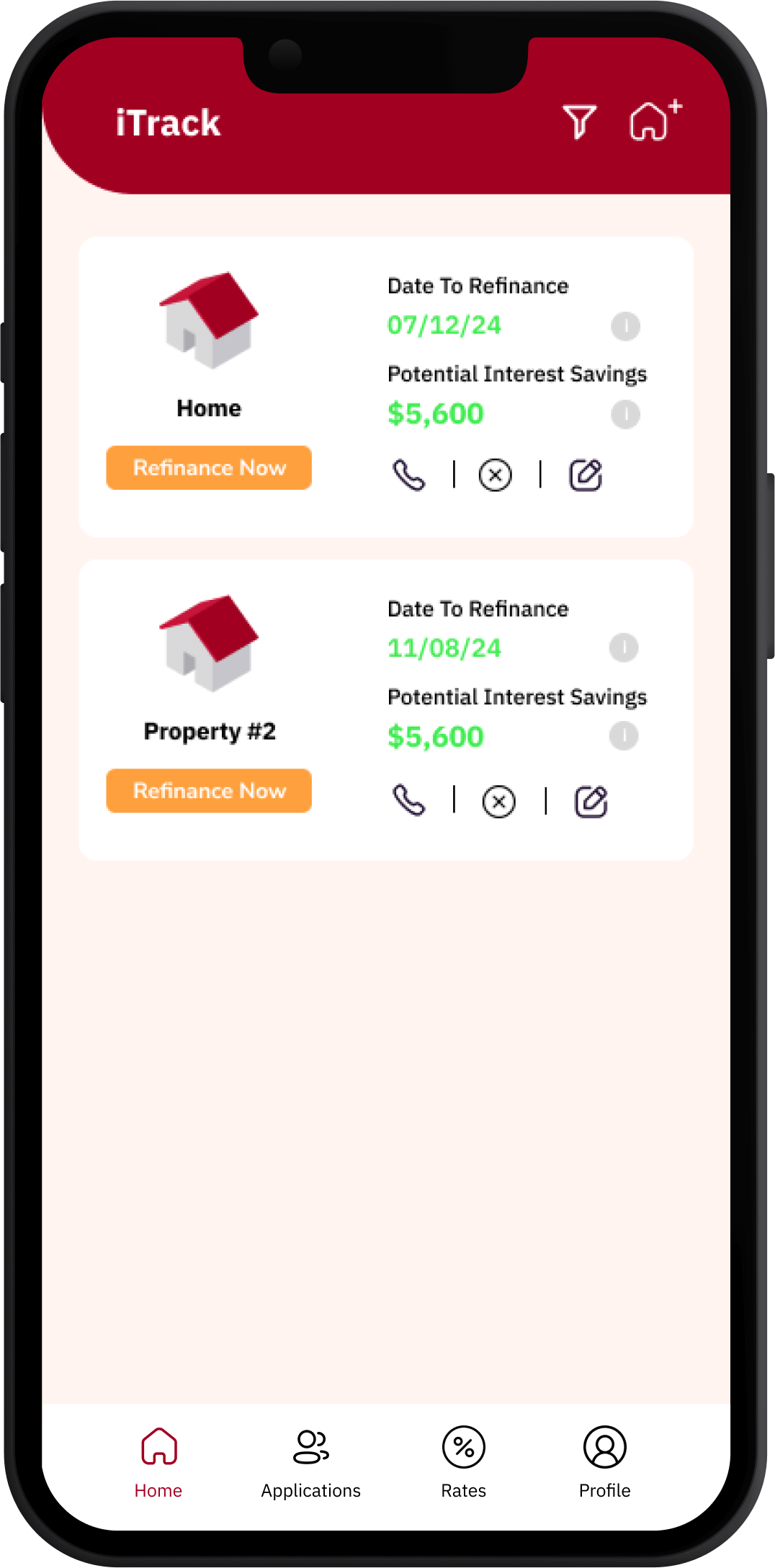

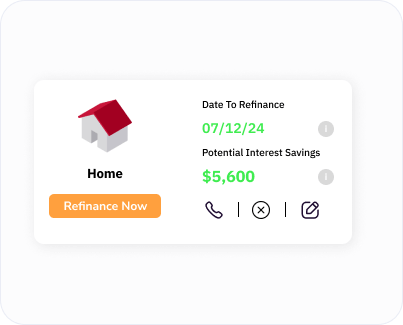

Stay on top of your mortgage loan with iTrack! This smart feature helps you monitor your refinance eligibility and calculates potential interest savings based on the current lowest interest rates available for you.

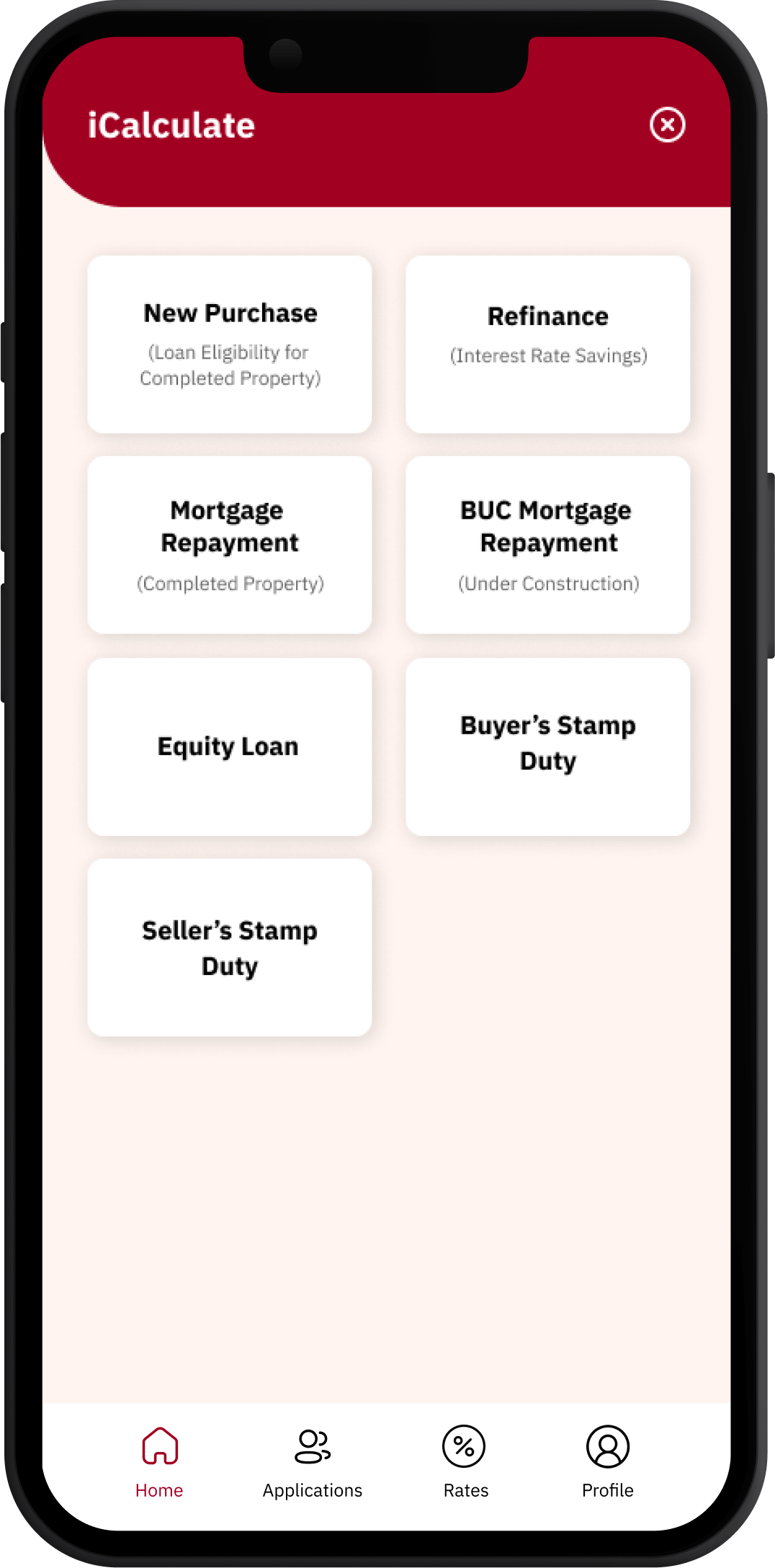

Make smarter financial decisions with ease! Our iCalculate feature gives you access to a suite of smart calculators designed to simplify your mortgage loan journey.

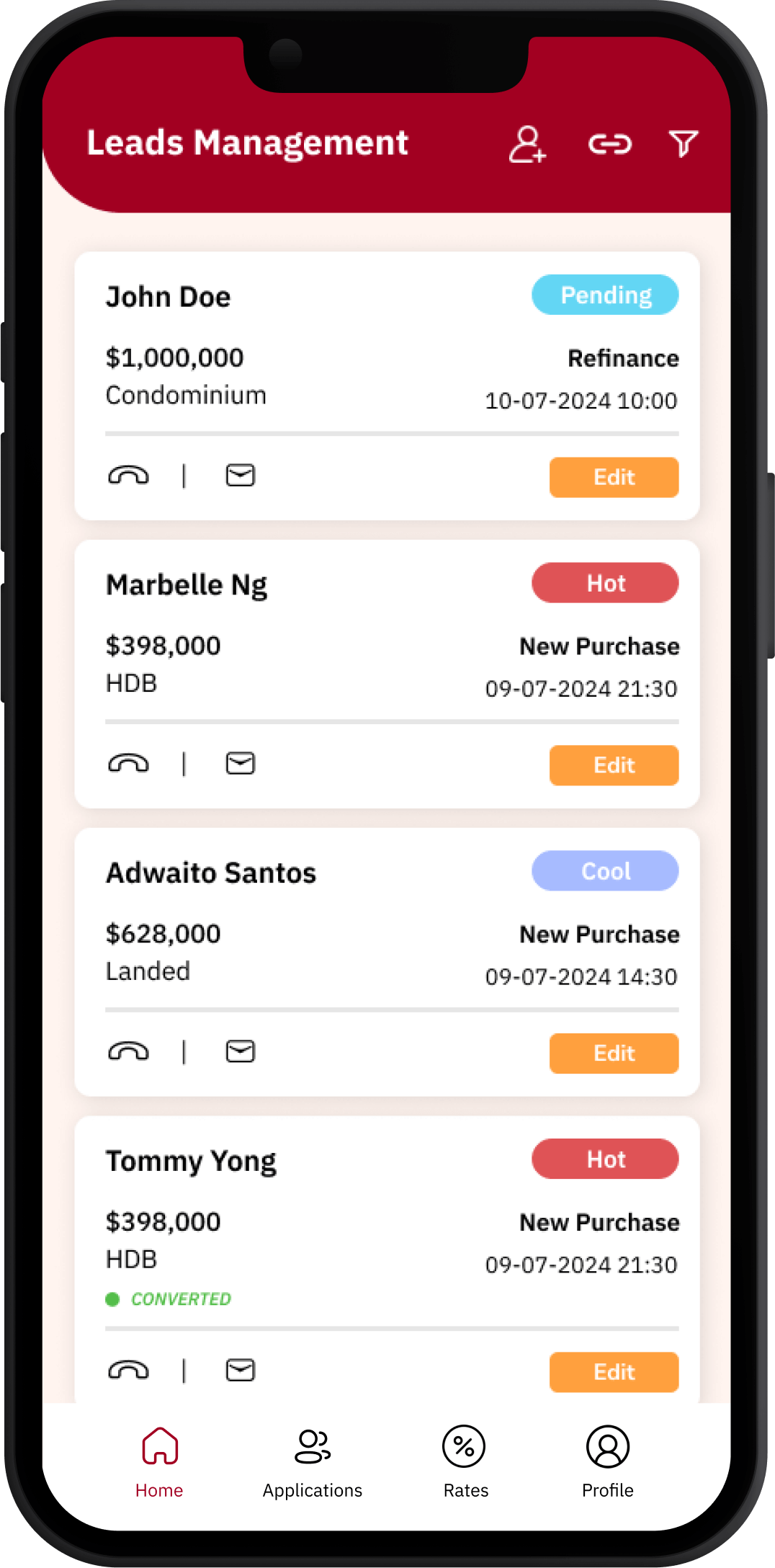

Easily share your lead gen link with clients and receive their submissions directly in your account for quick follow-ups and streamlined management.

Stay ahead with the most accurate and up-to-date information! Our real-time mortgage loan rates feature ensures that you always access the latest loan rates as they are updated.

Stay on top of your mortgage loan with iTrack! This smart feature helps you monitor your refinance eligibility date and calculates potential interest savings based on the current lowest interest rates available for your property.

Make smarter financial decisions with ease! Our iCalculate feature gives you access to a suite of smart calculators designed to simplify your loan journey.

Easily share your lead gen link with clients and receive their submissions directly in your account for quick follow-ups and streamlined management.

For years, homeowners were taught to fear one thing above all else when choosing a home loan: the lock-in period. Break the loan too early,...

At IQrate, we often hear this from homeowners: “I’ll refinance once rates drop a bit more.” It’s a good idea, but in reality, waiting for...

With property prices going up and interest rates changing, choosing the right home loan in Singapore is now harder than it used to be. Borrowers...