The digital revolution is changing daily life in Singapore. It affects how we shop, invest, and manage our money. The mortgage industry, once dominated by paperwork, physical appointments, and endless email threads, is now undergoing a remarkable transformation.

Thanks to digital adoption by banks and fintech innovators, securing a home loan has never been easier. What once required days now takes only minutes, bringing unprecedented speed, transparency, and convenience to homeowners.

A New Era of Home Financing

Singaporeans have grown increasingly comfortable managing their finances online whether it’s investing, purchasing insurance, or making payments. Now, mortgages are catching up.

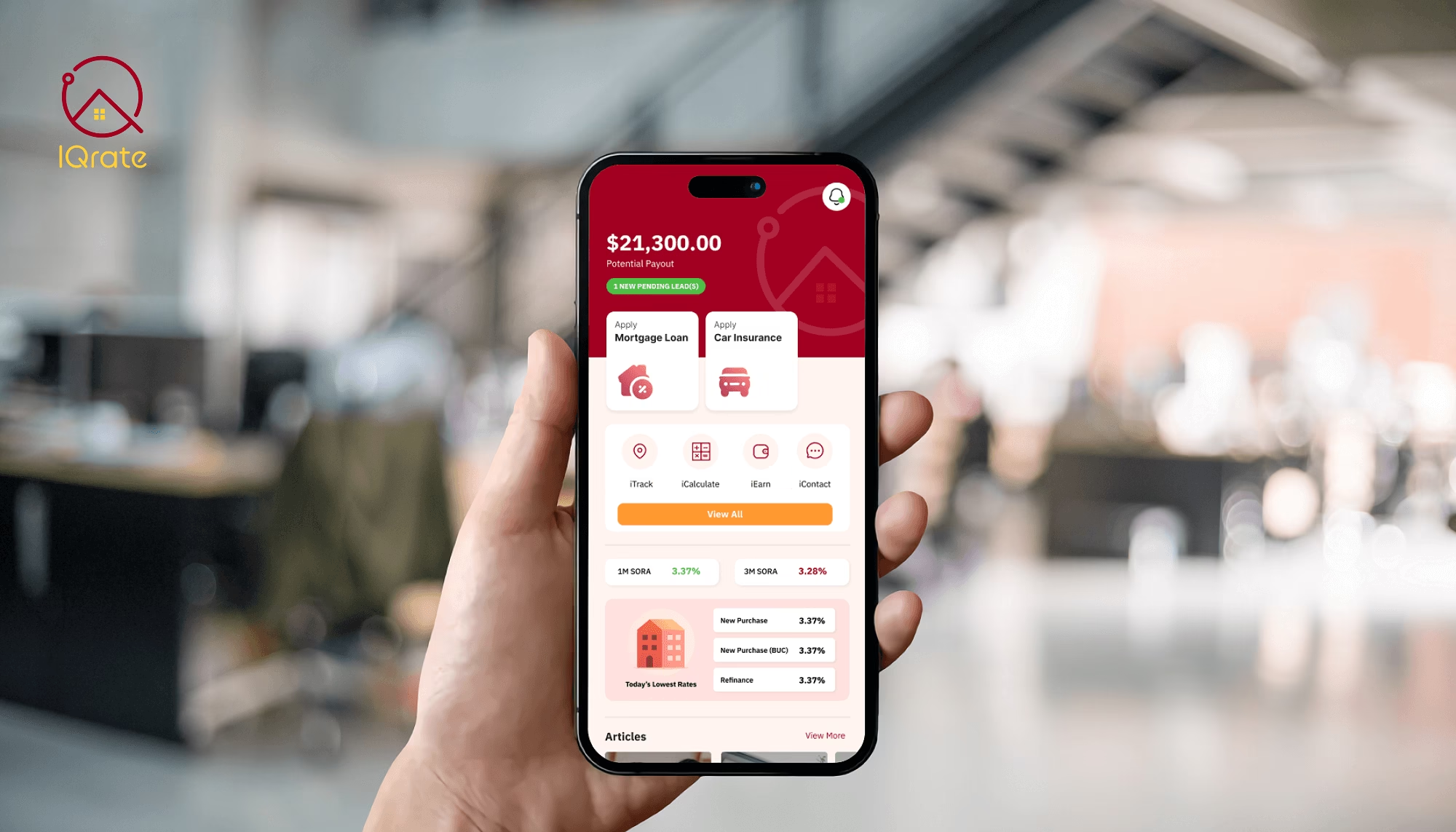

Digital mortgage platforms like IQrate let users see home loan rates from many banks in real-time. This allows users to compare packages easily, anytime, without needing to call or visit a bank branch.

Borrowers can now see lock-in periods, promotional perks, and rate changes all at once. This helps them make informed decisions quickly. Connecting themselves to mortgage bankers from the banks is now just fingertips away.

Smarter Tools, Better Decisions

Leading platforms are equipping homeowners with powerful and efficient tools such as:

- Tailored loan recommendations based on property type and loan quantum.

- Instant pre-approval eligibility checks, helping users estimate affordability without affecting credit scores. Generation of loan report for purchase planning purposes.

- Refinancing calculators to measure potential savings before switching banks.

- Automated reminders to conduct periodic home loan reviews and renewal opportunities just to ensure that they no longer overpay.

These smart tools give borrowers direct access to financial insights. This levels the playing field between consumers and professionals.

The Human Touch Still Matters

While technology simplifies the process, expert advice remains invaluable. IQrate fills this gap by providing the best of both worlds. It offers an easy self-service digital journey along with help from skilled mortgage brokers.

Borrowers can get help with structuring their loans. They can also learn how to optimize the loan term. Additionally, they can choose the best packages for their financial goals.

The Future of Mortgages in Singapore

As banks go digital and more people use fintech, the Singapore mortgage market is changing. Moving toward a future with speed, transparency, and trust. Borrowers gain control, banks engage clients faster, and the overall experience finally aligns with the modern lifestyle.

Thinking of refinancing or buying a new home?

Let IQrate guide your mortgage journey smarter, faster, and more transparent than ever. Download our app and experience the future of home financing today.

Download iOS version app