Mortgage industry is changing and it is time to make your move. With home loans now at an all-time high, your expertise in Singapore’s mortgage market and conditions might just be what’s needed to help your loved ones get the best, affordable home loan packages.

If you haven‘t yet heard of us, we are IQrate – a platform to help you get the best home loan rates in Singapore, and get you rewarded at the same time.

What IQrate Does

A short introduction to us: we are a bunch of home loan experts who saw a problem and turned it into an opportunity.

We all faced issues of varying degrees when we purchased our own homes: the home loan application process was tedious, sometimes confusing, and required several hours of research.

Hours that most of us need to take out of our daily lives.

We thought: If only this could all be automated.

Everyone buying a property in Singapore needs a home loan. If we could only make the process of choosing and applying for home loans in Singapore that much easier, we would be helping countless homeowners save time and effort.

This is how and why IQrate was built. The foundation of making home loans in Singapore an enjoyable and breeze process. Whether you’re a first-time home buyer or a seasoned property owner looking to refinance, IQrate offers a wide range of home loan rates to suit your needs.

Purchasing your own home is a joyous occasion – you shouldn’t be frowning and fumbling over tons of research and paperwork. It’s a milestone worth celebrating over. While the process of getting a home may be quite a headache, applying for a home loan can be effortless.

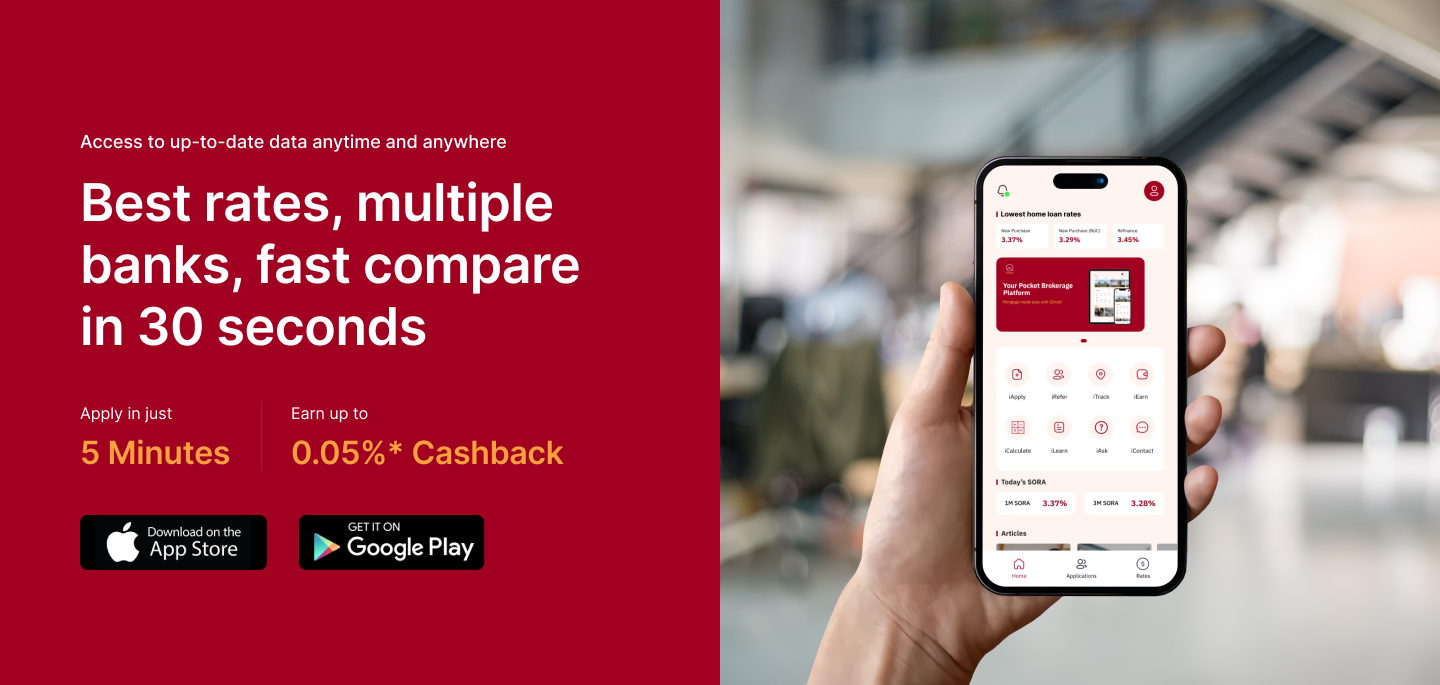

Our IQrate app removes the most mindless and laborious tasks and curates a list of home loan packaging and interest rates offered by major banks in Singapore. All you have to do is to choose a package that fits your financial needs.

With an easy-to-view gallery filtered based on your budget and loan repayment term, you can easily apply for a bank home loan of your choice.

Get rewarded for applying for a home loan in Singapore

To encourage and empower Singaporeans to learn more about their mortgage options and be savvier when it comes to home financing, we provide anyone above 21 years old an opportunity to become a mortgage broker.

Yes – we are the only existing mortgage platform that allows you to be a mortgage broker with us as we co-broke deals.

The concept is pretty simple – get certified after a quick tutorial with us, and once you are done, you can:

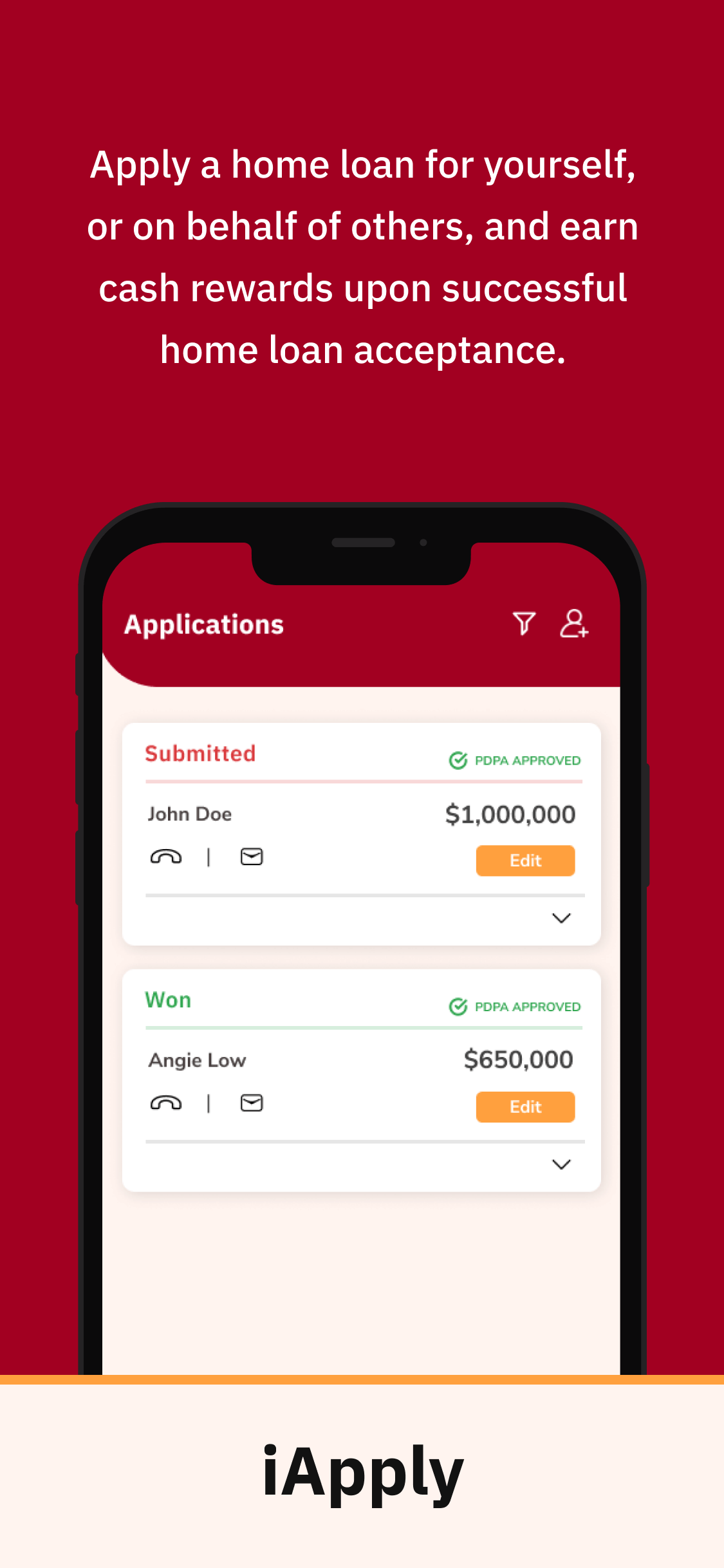

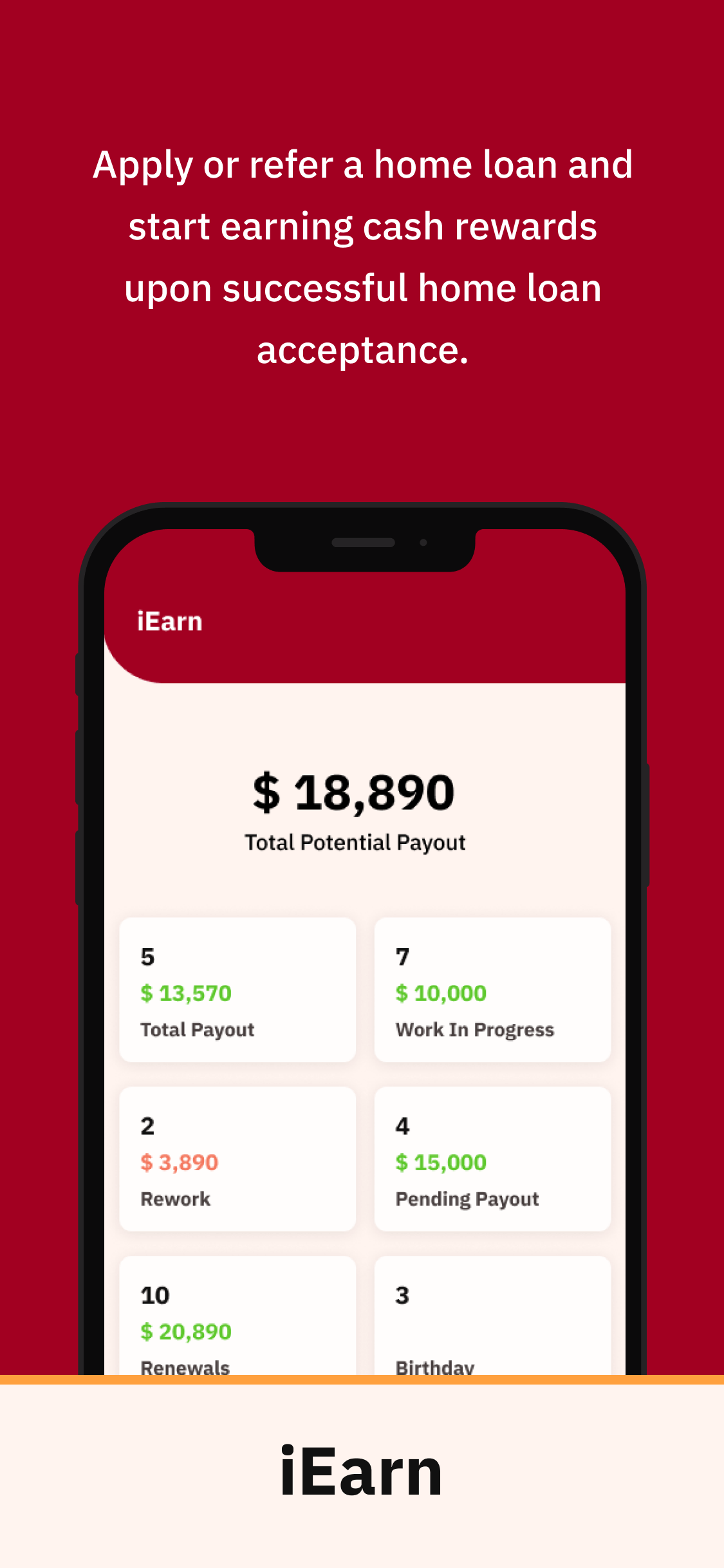

- Apply a home loan for yourself, or on behalf of others, and earn a referral fee upon successful home loan acceptance.

Apply for your own home loan, or on behalf of others at IQrate. You’ll handle the whole loan application process from start to finish and earn referral fees.

IQrate’s self-service AI automated platform will provide you with real-time home loan rates from partnered banks in Singapore and you can get rewarded* for every successful home loan acceptance.

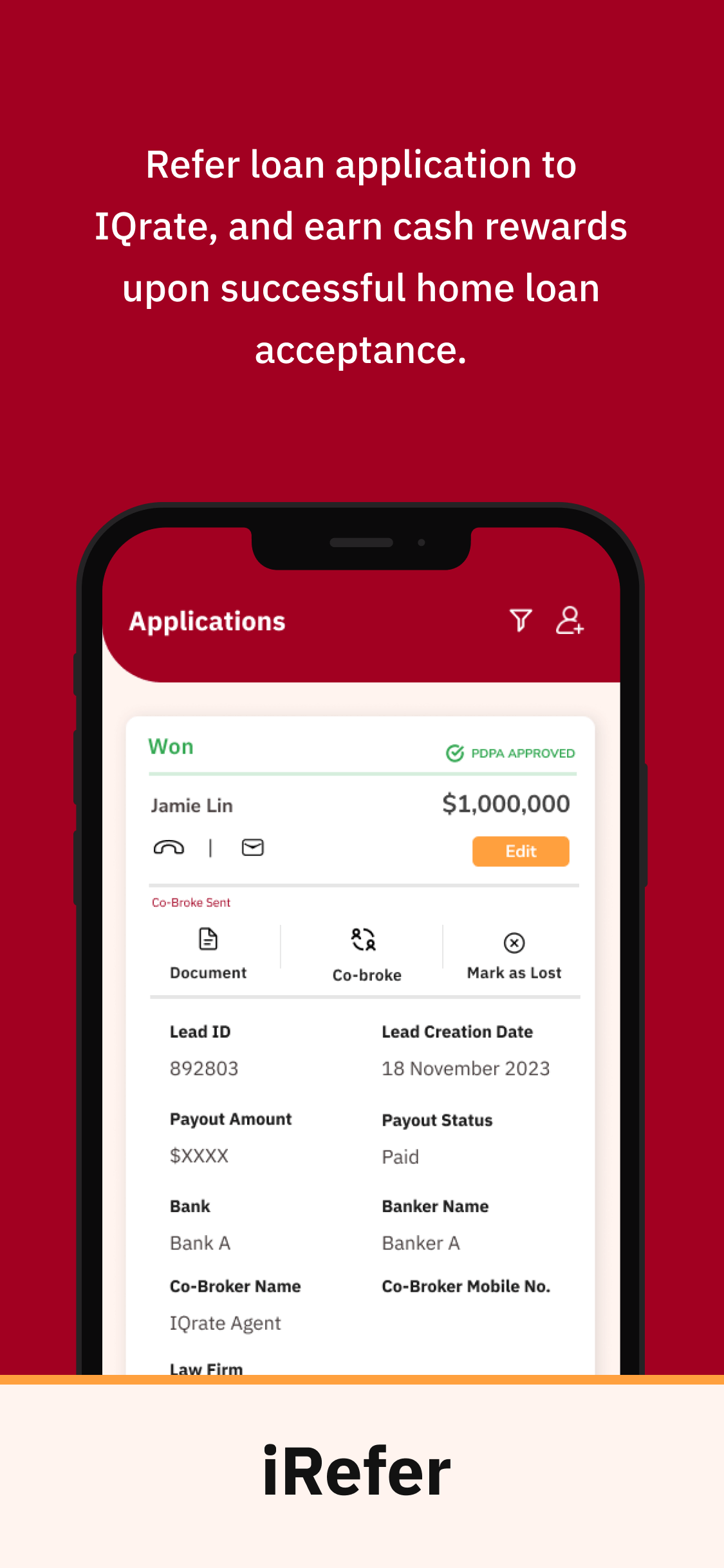

- Refer and recommend your loved ones to IQrate, and earn a referral fee upon successful home loan acceptance.

Earn referral fees for recommending friends, family or colleagues to IQrate for their home loan. Simply refer and IQrate will handle the whole home loan process with them. Be rewarded* for every successful home loan acceptance!

Do note that the referral fee will differ between applying and referring a home loan.