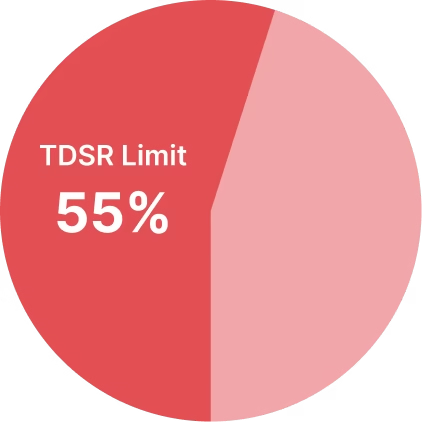

| Total Debt Servicing Ratio (TDSR) | Measures how much of your income goes to all monthly debt obligations, including the new loan. (including car loans, student loans, etc.) | Max 55% of gross monthly income |

| Mortgage Servicing Ratio (MSR) | Does not apply to private property purchase. | – |

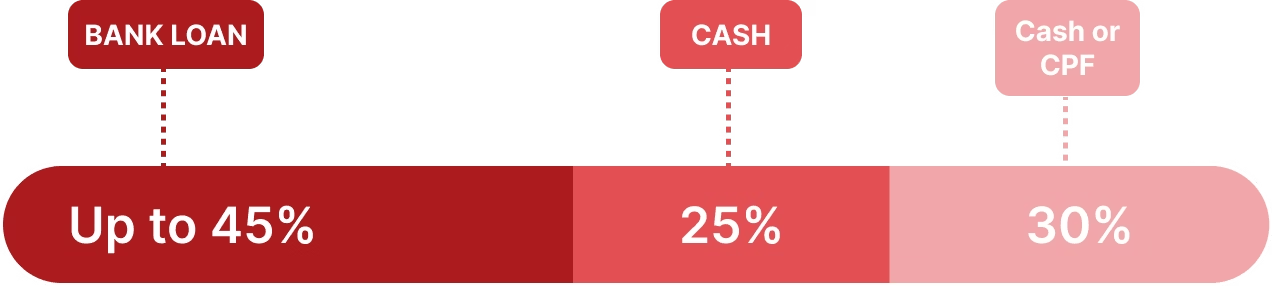

| Loan-to-Value (LTV) Ratio | The portion of the property price/value you can borrow. | Up to 75% (with 25% down payment) |

| Borrower Age & Loan Tenure | The combined age of borrower(s) and length of loan must meet regulatory/ bank limits. | Loan tenure for private property is up to 30 years or until the borrower turns 65. It can be extended to 35 years or until age 75, but the LTV drops to 55% and the minimum cash downpayment increases to 10%. |

| Income & Credit Assessment | Bank checks fixed income, variable income (with “haircut”), employment history, credit score. | All variable income (such as bonuses, rentals) may be discounted (only 70% counted) when computing your gross monthly income for TDSR. |

| Property Remaining Lease / Ownership Conditions | The remaining lease of the property and previous ownership of private property may affect eligibility. | If property has short remaining lease the LTV may be lowered. Also prior private property ownership may affect some loan types. |