Purchasing a new launch condominium in Singapore involves several key steps, from financial planning to collecting the keys. Below is a detailed guide to help you navigate the process.

1. Financial Planning & Loan Eligibility

Determine Your Budget

- Consider upfront costs such as the Booking Fee (5%), Buyer’s Stamp Duty (BSD), and if applicable, Additional Buyer’s Stamp Duty (ABSD).

- Ensure that your loan amount falls within the Total Debt Servicing Ratio (TDSR) limit (55% of your monthly income).

- For Executive Condominiums (ECs), check your eligibility based on income and family nucleus.

Secure an In-Principle Approval (IPA)

- Apply for In-Principle Approval (IPA) from banks to know the maximum loan amount you qualify for.

- Comparing home loan packages from various banks and financial institutions can take place after confirmation on the purchase of a property as interest packages change from time to time (IQrate can assist with this).

2. Research and Shortlist New Launch Condominium

Compare New Launch Condos

- Consider factors such as location, developer reputation, tenure (freehold vs. 99-year leasehold), and amenities.

- Research upcoming projects from URA, PropertyGuru, 99.co, or developer websites.

In Q1 2025, Singapore will see 12 new condo launches, including:

- The Orie (Toa Payoh, D12) – Near Braddell MRT, prices start from $1.28M for a 1-bedroom, launched.

- Arina East Residences (Tanjong Rhu, D15) – Freehold, 107 units, strategic location between CBD & Paya Lebar.

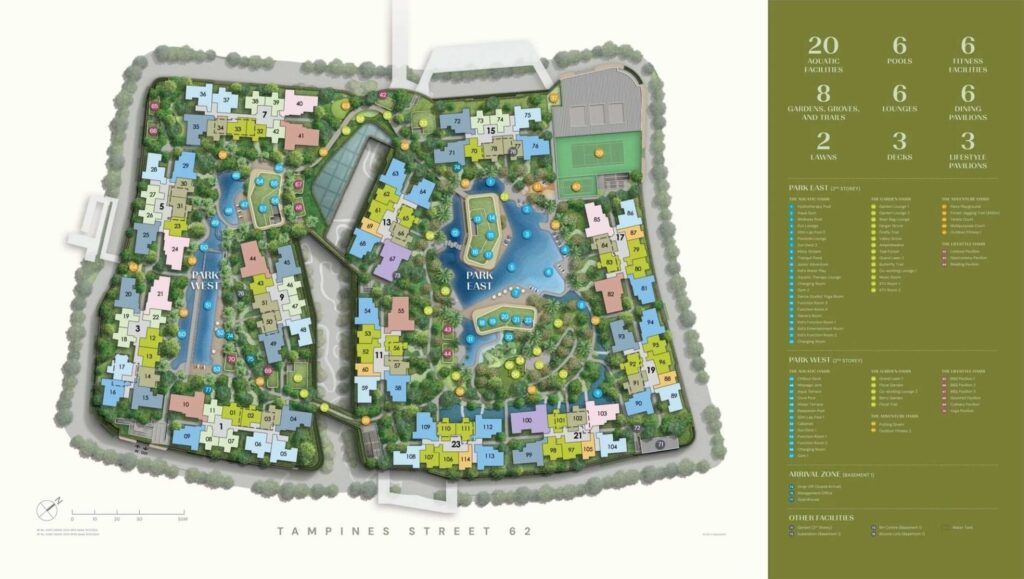

- Parktown Residence (Tampines Ave 11, D18) – 1,193 units, major mixed-use development, launched.

- W Residences Marina View (D1) – High-end project in Marina Bay

Each condo has different price points, tenure (freehold vs. leasehold), and amenities. Research upcoming launches based on location, transport links, and nearby schools.

Visit Showflats & Attend Previews

- Observe unit layouts, quality of finishes, and site plans of the new launch condominium.

- Compare pricing and check financing options with mortgage brokers like IQrate.

3. Balloting & Booking a Unit

Register for the Preview & Ballot

- Express interest early to receive VIP previews and pricing information.

- Popular projects may have a balloting system to allocate units fairly.

Select a Unit & Pay the Booking Fee

- Pay 5% of the purchase price to secure your unit.

4. Sign the Option to Purchase (OTP)

Receive the OTP from the Developer

- The developer issues the Option to Purchase (OTP), which is valid for 3 weeks.

Secure a Home Loan & Finalize Financing

- Within the 3-week period, finalize your home loan with a bank.

Pay Buyer’s Stamp Duty (BSD) & ABSD (if applicable)

- BSD must be paid within 14 days of signing the Sales & Purchase Agreement (SPA).

- ABSD applies from first property onwards to foreigners (60%) and Singapore PRs (5%) unless exempted.

5. Progressive Payment & Construction Period

Follow the Progressive Payment Schedule

- Payments are made in stages as the condo is built.

- Use CPF savings to cover part of the payments if eligible. Take note that there is an order of payment in the form of cash first, followed by CPF then bank loan.

6. Key Collection & Defect Inspection

Receive Temporary Occupation Permit (TOP)

- When construction is complete, the developer obtains a TOP, and buyers can collect their keys.

Conduct a Defect Inspection

- Developers provide a 1-year Defects Liability Period (DLP) to fix any issues.

Move in or Rent It Out

- Once defects are resolved, you can move in or rent out your unit.

Final Thoughts

Buying a new launch condominium is a long-term commitment and requires careful financial planning, affordability, and research, before making any timely decision-making. Need mortgage advice? Platforms like IQrate can assist with securing the best home loan rates. 😊

Contact us now to schedule a personalised and free consultation.