2023 saw a rise in property prices of up to 12% for new private homes and 5% for resale HDB flats. For many Singaporeans who purchased and considered purchasing homes this year, were faced with much larger home loans. So, what does this mean for a homeowner or potential homeowner, moving into 2024?

In this article, we will be taking a look at the Total Debt Servicing Ratio (TDSR): what is it, and how it affects your home loan?

What is TDSR

TDSR is a limit set by the government to determine how much we can borrow. This ensures that we will not be too overwhelmed when taking out a large loan to pay for big-ticket purchases like a house.

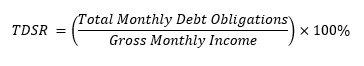

It is calculated as follows:

For a more in-depth explanation of the TDSR, please click here.

For this article, all you need to know is the following 3 things:

- Total Monthly Debt Obligations include everything from the monthly instalment of the home loan, credit card loans, car loans and etc

- Any variable income added to the Gross Monthly Income must have 30% of its value taken away, due to the volatile nature of the job.

- The current limit is set at 55%, meaning that if you make S$10,000 a month, you may not have more than S$5,500 in monthly debt repayments.

How does the TDSR affect your home loan?

Okay, so we know what the TDSR is and how it limits the amount of loan you can take out. But what are some other ways it can affect you?

1. Investing becomes a little bit trickier

With property prices in Singapore being on the steeper side, it will be quite unlikely that you will be able to take out a loan or two to buy another house without exceeding the 55% limit.

2. Amount available for loan to those with variable income is low

Around 11% of the labour force in Singapore works non-permanent jobs according to the 2023 Labour Force in Singapore Report. These non-permanent jobs include either working a fixed-duration contract or on-call jobs.

People in the gig economy will not be able to take out as much money as those working full-time jobs. This is because only 70% of their salary will be counted in the TDSR calculations. Therefore, even if they make the same money, they will only be able to take out a smaller loan.

3. Even if you have no debts, how much you can borrow is limited

According to the Monetary Authority of Singapore (MAS), the monthly debt obligations have to be calculated using a medium-term interest rate.

This medium-term interest rate is a stress test implemented by the government to make sure that Singaporeans will be able to handle a sudden spike in interest rates.

Currently, the medium-term rate is as follows:

| Type of loan | Medium-term interest rate |

| Residential property purchase loans and mortgage equity withdrawal loans | The higher of a 4% floor or the thereafter interest rate. |

| Non-residential property purchase loans and mortgage equity withdrawal loans | The higher of a 5% floor or the thereafter interest rate. |

Given that the actual current interest rate is 3%, calculating obligations with the 4% figure would lead to a greater amount of debt, increasing the TDSR. This prevents you from borrowing more money.

Potential misunderstandings on how the TDSR might affect your home loan

All right, so we’ve seen how the TDSR may affect you in taking out a home loan.

Let’s now look at how it WON’T affect your home loan

1. TDSR is not related to the value of your property

Some people think that if the value of the house is greater than the value of the home loan, the bank would give them the loan.

This is simply not the case. All that matters to the bank is whether the amount of loan you take on will keep within the TDSR, regardless of the value of the house.

2. Don’t assume that stock dividends are included in the TDSR calculation

Now, don’t be confused, stock portfolios can be counted as your income (more on this later), but will the dividends be counted as part of your income? Well, that depends.

Some banks may count part of it, some may not count it at all. To be safe, do your research and check with your bank before moving forward.

3. TDSR is a “cooling measure”

Indeed, the government has recently released a slew of cooling measures which affect things like the medium-term interest rate.

While some of these measures are temporary and subject to future circumstances, the TDSR is not one of them. The TDSR is a permanent change to the process of obtaining a home loan in Singapore.

What to do if you can’t meet the TDSR requirements

1. Work on your debt management

If you have a substantial amount of debt, there is a lower likelihood of you being able to take

another loan without exceeding the 55% limit.

It is a good idea to start paying off your debt about a year before you plan to apply for a home loan.

A home loan financing advisor might be able to help you manage your debt with various strategies like debt consolidation and balance transfers.

There are, however, a few points you must take note of:

- Do not apply for new credit cards or take personal loans two months before your home loan application

- Try to clear any outstanding car loans before applying.

- Make sure you clear your debts one month before applying for a home loan as your credit score refreshes every month

- If you never took out a loan before, take out a small loan (maybe apply for a credit card and charge something to it) and pay it back immediately. Not having any loans gives you a credit score of “Cx”, which means the bank doesn’t know how reliable you are.

2. Notify the bank of any fixed deposits or share portfolios you may have

If you highlight any fixed deposits or share portfolios in your Central Depository Account (CDA), the bank might take it that you have a higher income level.

For the former, it depends on how sizable your fixed deposit is. For the latter, it depends on the bank how much they decide it impacts your TDSR.

It may be a good idea to contact a home financing advisor to compare which banks have the most beneficial calculation for you and aid you through the paperwork.

3. Declare any rental income you are earning

If you are currently renting out any properties, be sure to let the bank know so that they can include it as income in the calculations for your TDSR.

That said, for it to be counted, there must be an active Tenancy Agreement (TA) with at least 6 months of tenancy from the date of the loan disbursement.

You must also have a valid stamp duty certificate from IRAS.

Please note that like all variable income, only 70% of rental income will be factored into the

calculation.

4. Exclude any co-borrower who has a lot of debt

If you are thinking of taking out a loan with a friend or family member, check which among them has the most amount of debt.

If they have a significant amount of debt, it may be a better idea to choose someone else who has less debt or take on the loan as a sole borrower.

Still confused about TDSR and your Home Loan?

Reach out to us at IQrate! We understand how confusing it is and are happy to walk you through the process to make it as painless as possible.

We’ve partnered with all the banks in Singapore so that your friends, family, and clients are guaranteed the lowest rates on their home loans without having to do any research. Take advantage of IQrate’s self-service features and save time and money. And most importantly, GET REWARDED!