The Total Debt Servicing Ratio (TDSR) is a threshold set by the Monetary Authority of Singapore (MAS) to ensure that borrowers are not over-leveraged for property purchases.

In 2021, the Singapore government has tightened the TDSR by 5% points, from 60% to 55%. If you’re kind of new to the whole property deal in Singapore, this news might’ve been: eh, what is the TDSR?

Not to worry, here is your one-stop guide to the TDSR and how it will affect you – now or in the future.

What is TDSR?

Simply put, the TDSR is a threshold set by MAS to limit the amount of money people can borrow. It was implemented to prevent people from becoming overburdened with debt from their property loans.

It also prevents property speculation, where people would take large loans to buy a property and then flip it for a profit.

How is TDSR calculated?

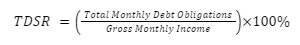

Essentially, it is calculated using the formula as shown:

It looks a bit complicated, but don’t worry, it’s simpler than it seems.

One thing to note here is that included in the total monthly debt obligations are the monthly instalment of your existing home loan and other miscellaneous loans like car loans, student loans and even credit card loans.

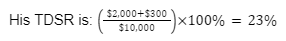

Let’s work it out through an example.

In this case, the borrower has a gross monthly income of S$10,000 with S$2,000 in his existing home loan repayment, alongside S$300 in car loan repayment.

The current limit is 55%, therefore, the borrower cannot take a loan if it’ll make his total monthly repayments exceed $5,500.

Not too bad, right? Of course, there are multiple situations that may change how this formula is calculated, so let’s go through them.

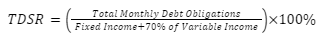

Firstly, if you have variable income (i.e., from rent), just add it to your fixed income if you have any. Do take note that in calculating the TDSR, you will need to take off 30% of your variable income due to the volatile nature of your job. So, in short, your TDSR will be calculated as follows:

Secondly, if you are applying with someone else for a joint loan, just add your incomes and debt obligations together.

How does TDSR affect you?

While this measure may achieve its intended effect of cooling down the market, it can also affect you personally. Let’s take a closer look.Even if you do not have any debts, you may be unable to take out more loans.

This is because the 55% limit is calculated based on a value set by the government called a “medium-term interest rate”, which essentially works as a stress test to see if you would be able to manage financially if there is a spike in the interest rate.

In other words, the TDSR operates independently from the current interest rates, and you would have to maintain the same percentage to purchase another property, even if your monthly debt obligation rises due to a spike in interest rates.

For property investors, this is a bad sign.

Even without having other miscellaneous loans, you would most likely still have outstanding payments from your first home loan.

Coupling this with the fact that Singaporean house prices grew by 13.6% year-on-year in September 2022, this means that you are less likely to be able to take on another mortgage while staying within the 55% TDSR threshold.

Still, it is possible if you focus on repaying your current debt first or refinancing your loan to reduce mortgage payments. That way, you will still be able to keep the total debt repayments to an amount low enough to stay within the limit.

For those with variable incomes, taking out a loan may become more difficult.

As mentioned, only 70% of your variable income is taken into consideration when checking your eligibility for a loan. With the rise of the gig economy, characterised by having your entire income fluctuating, many people may not be eligible to take out larger loans.

So, while it may be tempting to under-declare your income for tax reasons, it may be wise to scrap the idea, if you wish to take out a loan in the future.

Mortgage Servicing Ratio (MSR)

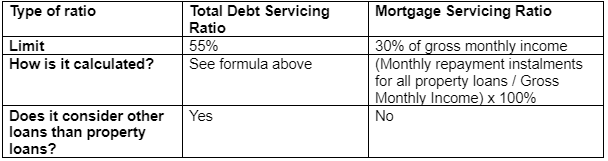

If you have previously taken out a loan, especially an HDB flat, you may be familiar with the terms Mortgage Servicing Ratio (MSR). TDSR and MSR are fundamentally different.

Similar to the TDSR, the MSR is also a limit set by MAS to determine how much money you can borrow. However, in this case, the MSR is only considered for the purchase of HDB flats or EC directly from the developer. Its limit and values used in the calculation are also different.

The important differences are summarised in the table below:

Source: MAS (Information and values are accurate as of 01 October 2023)

As we can see, generally, the TDSR is more comprehensive than the MSR, though both are used when taking out a loan to purchase an HDB flat or EC directly from a developer.

Exemptions from the TDSR

As with most rules, there are exceptions. Generally, exemptions from TDSR fall under 3 categories:

First category: those who are refinancing their home loans

If you have encountered any financial difficulties or taken on more loans since getting your home loan, please be rest assured that the TDSR will not apply to you.

You will be able to refinance your home loan without issue, at least for a property that you are currently staying in.

As for loans on investment properties, you’ll be able to refinance your loan past the limits of the TDSR if these conditions are fulfilled:

- You commit to a debt reduction plan, repaying minimally 3% of the outstanding balance over not more than 3 years

- The financial institution’s credit assessment is fulfilled

Second category: those seeking mortgage equity withdrawal loans (MWLs)

According to MAS, MWLs are loans secured against the value of the borrower’s residential property.

The TDSR rules will not apply to MWLs as long as the Loan-to-Value (LTV) Ratio is not more than 50%.

This means that the mortgage amount must not be more than half of the value of the appraised property value.

If you are looking to retire, this exemption allows you to monetise your company.

Third category: everyone else

For rare situations that do not fall under the above categories, the TDSR framework provides conditions to allow for the loan to exceed the TDSR limit.

These are:

- Document(s) clearly stating the exceptional reasons for granting property loans above the threshold.

- Subject these exceptional cases to enhanced credit evaluation.

- Implement a debt reduction plan with borrowers under these exceptional cases.

- Report all such exceptional cases to MAS.

Furthermore, there are requirements for some of these conditions, shown in the table below:

| Requirement | Details |

|---|---|

| Subject exceptional cases to enhanced credit evaluation |

|

| Implement debt reduction plans (for refinancing of loans) | The borrower must commit to a debt reduction plan with the FI. |

| Report such cases to MAS | All loans exceeding the 55% threshold must be reported to MAS. At the minimum, the report should include:

|

Still confused about TDSR and your Home Loan?

Reach out to us at IQrate! We understand how confusing it is and are happy to walk you through the process to make it as painless as possible.

We’ve partnered with all the banks in Singapore so that your friends, family, and clients are guaranteed the lowest rates on their home loans without having to do any research. Take advantage of IQrate’s self-service features and save time and money. And most importantly, GET REWARDED!